Business Cycles & Investment Implications

UCSB Econ SIP Certificate Course x499.05

Course Description

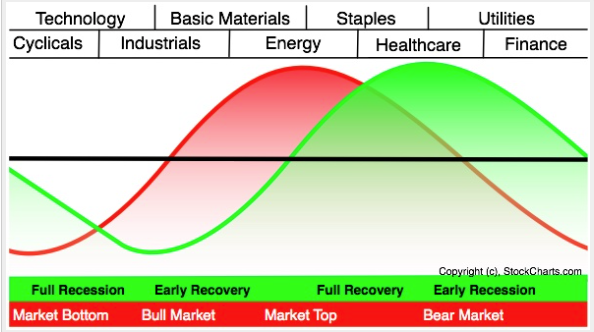

Managing portfolios in the face of economic fluctuations can be one of the most vexing challenges facing decision makers. This is particularly so when considering how unexpected shifts can prompt costly dilution of even the best laid business plans. This course employs actual case studies to explore how business cycles influence economic activity and portfolio performance, which industrial sectors make the most sense and which to avoid at given stages, and how indicators can help us identify what current cycle phase may prevail.

WHAT YOU WILL LEARN IN ETF’S & PORTFOLIO CONSTRUCTION UCSB Econ x499.05:

By the end of this course you will be able to:

- Understand business cycles and investment adjustments that can capitalize on them

- Know how indicators and yield curves can help to determine current cycle phase

- Understand risk on vs risk off and investment implications

WHAT MITCHELL KAUFFMAN BRINGS TO BUSINESS CYCLES & INVESTMENT IMPLICATIONS (UCSB Econ x499.05):

The innovative portfolio strategies that Professor Mitch Kauffman employed during his 35+ years as a Certified Financial Planner™ helped effectively manage client investments toward their portfolio growth goals and risk parameters.